Google Ads Case Study: Optimizing Campaigns for Alcohol Fermentation Yeast in a Volatile Market

Client: Manufacturer & Online Retailer of Specialized Fermentation Yeasts

Product Range: Turbo Yeasts, Wine Yeasts

Target Markets: Moonshiners

Timeframe: June – August 2024

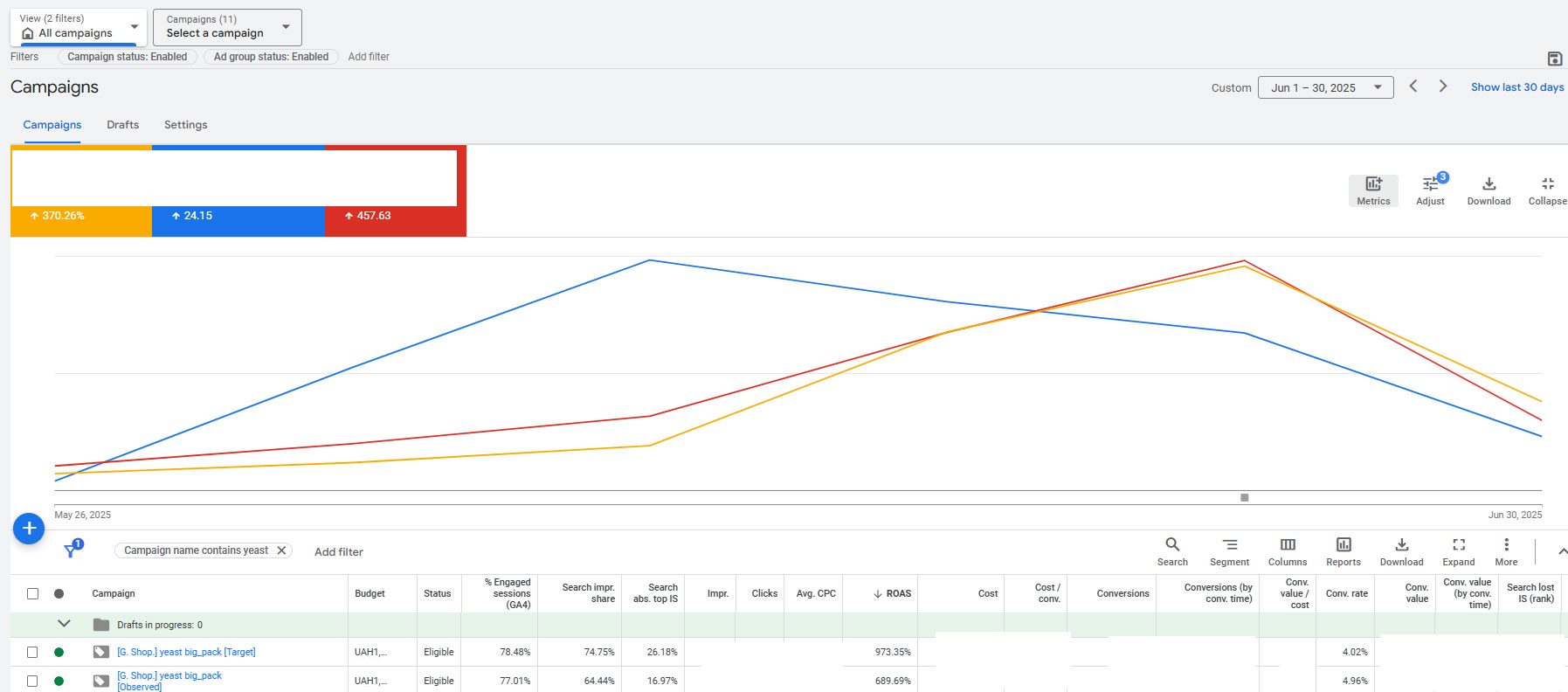

Objective: Restore ROAS, increase conversion volume, and stabilize CPC amid declining performance

Background & Initial Challenge

In June 2024, the client approached me as a Google Ads specialist due to a sharp decline in website conversions and a rapid increase in cost per acquisition (CPA). Despite maintaining consistent ad spend, ROAS had dropped from 420% to 260% over the previous 3 months.

The most concerning trend?

📉 Conversions were falling faster than costs were rising — a clear sign of inefficiency in targeting, audience alignment, or auction strategy.

The business sells:

- Turbo yeast (fast-fermenting, high-alcohol-tolerance strains)

- Yeast nutrients and fermentation kits

Previously, the account performed well with manual campaigns and strong impression share. But something had changed.

I began with a comprehensive audit across tracking, structure, and market dynamics.

🔹 Tracking & Data Layer

- Verified Google Merchant Center feed: product titles, availability, pricing

- Audited GA4: confirmed accurate event tracking (view_item, add_to_cart, purchase)

- Reviewed GTM: all Google Ads conversion tags firing correctly

- Checked UTM consistency across campaigns

✅ No tracking issues detected — data was reliable.

🔹 Product & Keyword Review

- Analyzed shifts in bestsellers: demand moved from single yeast packs to bulk and starter kits

- Reviewed ad copy and keyword match types

- Checked Top Impression Share and Absolute Top Impression Share — both had dropped significantly

Instead of blaming “the algorithm,” I dug deeper:

- Why were people clicking but not converting?

- Was traffic quality down?

- Had buyer behavior changed?

I requested historical data on:

- Average Order Value (AOV) by product category

- Conversion rates by audience segment

- Device and geography trends

🔍 Critical Discovery:

While overall traffic remained stable, conversion rate and AOV dropped by ~60% — but only in one key audience segment.

This group used to be experienced home distillers and brewers — technically skilled, high-LTV customers.

Now, the data showed a surge in young urban users searching for quick, cheap fermentation solutions, likely influenced by economic hardship and rising alcohol prices.

📌 Hypothesis: Due to regional instability (ongoing conflict), lifestyle shifts occurred. Former hands-on creators are now displaced or focused on survival — not leisure brewing.

❌ Test #1: Performance Max (PMax) Campaigns

Goal: Use Google’s AI to scale conversions on best-selling yeast products.

Setup:

- PMax campaign focused on top SKUs: Turbo Yeast 48h, Wine Yeast Kit

- High-quality assets, clear CTAs, proper conversion tracking

Result: ❌ Failure after 12 days

- CPC spiked to $0.7 (vs. historical $0.13)

Traffic came from irrelevant queries: yeast for beer, yeast for wine, yeast for bread, spirit

Automated bidding pushed into high-cost, low-relevance auctions.

💡 Lesson: Despite continuously excluding irrelevant phrases, the process yielded no meaningful outcome.

❌ Test #2: Manual CPC + Segmentation Script (Mike Rhodes Model)

Approach:

Used custom scripts to split campaigns into:

- Profitable

- costly

- flukes

- meh

- zeroconv

- zombie

Applied manual CPC with bid adjustments.

Result: Slight improvement, but not enough

- Best ROAS: ~310% (still below 400% target)

- CPC remained high due to auction pressure

- Conversion volume flat

💡 Lesson: Manual control helps, but without audience-level separation, you’re still bidding against yourself and the wrong users.

As performance from the once-effective audience declined, I identified the need to realign targeting. I rebuilt the campaign architecture around product category and audience intent.

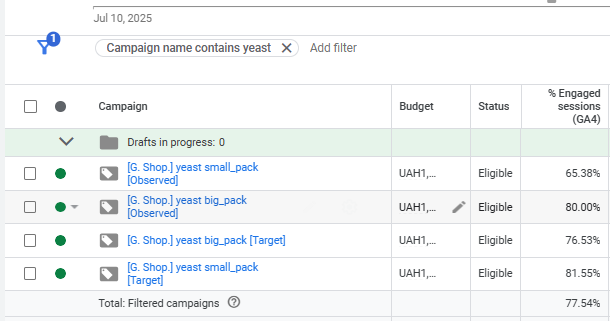

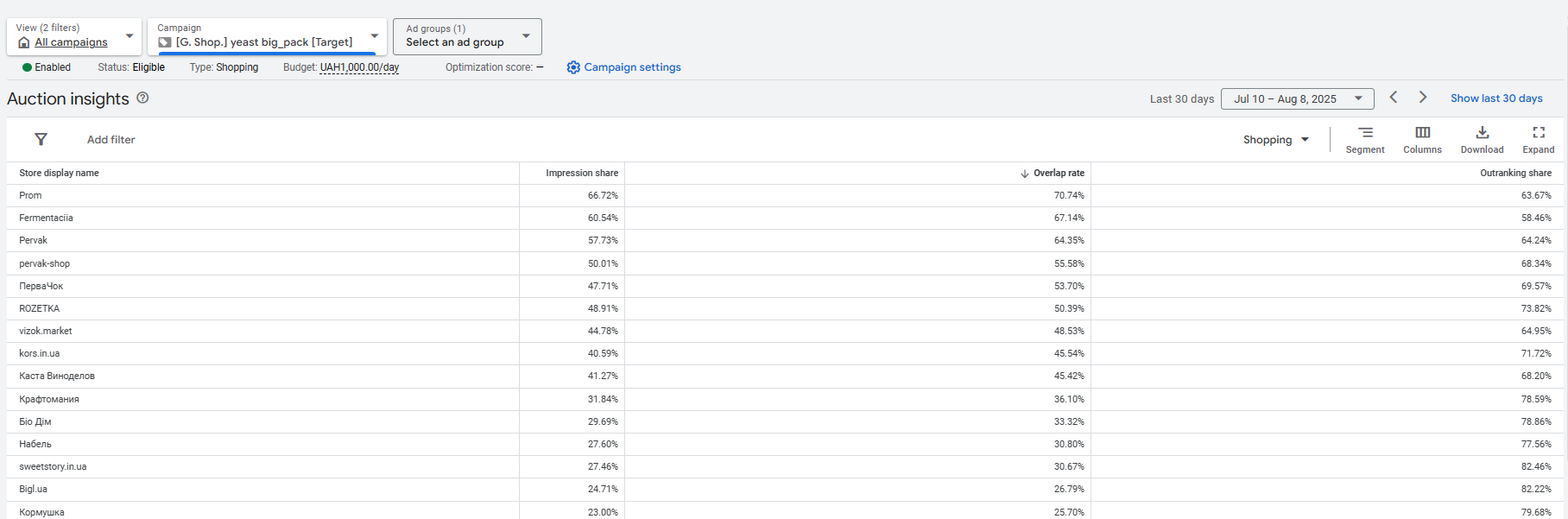

✅ New Campaign Structure (Launched July 2024)

1. By Product Category:

- [Campaign] Turbo Yeast (Fast Fermentation)

- [Campaign] Yeast Nutrients & Additives

Structure

2. By Audience Intent:

[Campaign A] Shopping | Turbo Yeast → Targeting High-Intent in-market audience

[Campaign B] Shopping | Turbo Yeast → Audiences (all eligible audiences with observation)

→ 90% bid adjustment down for audiences in Campaign A

→ Excluded branded terms to avoid cannibalization

🎯 Rationale: Protect high-LTV customers from inefficient broad traffic. Use separate campaigns to capture new users at lower cost.

Used Target Impression Share bidding with clear KPIs:

- >60% Impression Share on Top of Page

- >15% Absolute Top Impression Share

- Outranking share vs competitors: > 30%

Competition

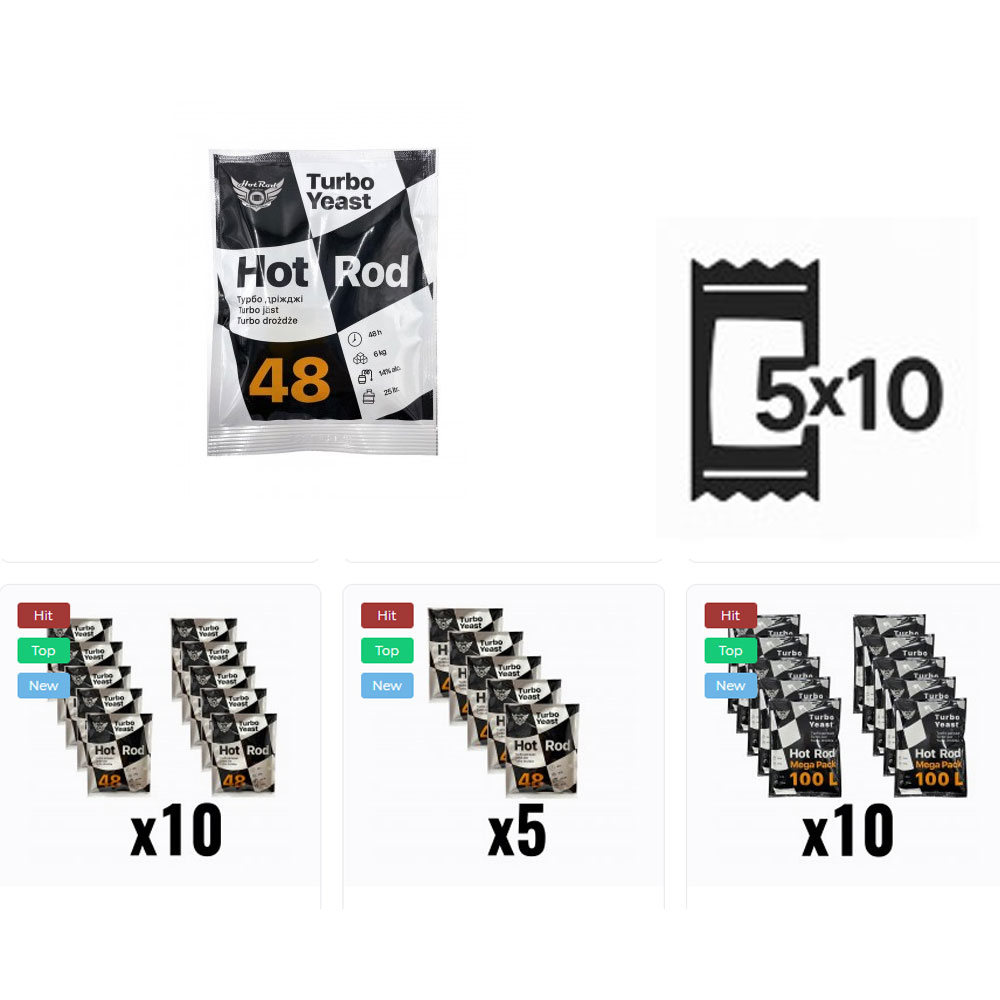

Instead of relying solely on ad optimization, I worked with the client to implement a product-level strategic change: repositioning how yeast was packaged and sold.

Historically, the main SKU was a single packet of turbo yeast (60g) — suitable for 25 liters of mash. While this worked for trial users, it didn’t reflect real user behavior: experienced fermenters typically produce 50–100+ liters at a time and need multiple packets.

So we introduced a new bulk-ready offer directly in the product catalog:

✅ "5-Pack Turbo Yeast Bundle"

- Enough for 125 liters of mash

- Priced at 12% discount vs. buying 5 singles

- Clear label: x5

This wasn’t just a bundle — it was a new default offer, promoted as the main variant in Google Ads and on the product page.

- Set higher bids on the 5-pack SKU using portfolio bid strategies

From 1 to 5 (10)

Instead of relying solely on ad optimization, I worked with the client to implement a product-level strategic change: repositioning how yeast was packaged and sold.

Historically, the main SKU was a single packet of turbo yeast (60g) — suitable for 25 liters of mash. While this worked for trial users, it didn’t reflect real user behavior: experienced fermenters typically produce 50–100+ liters at a time and need multiple packets.

So we introduced a new bulk-ready offer directly in the product catalog:

✅ "5-Pack Turbo Yeast Bundle"

- Enough for 125 liters of mash

- Priced at 12% discount vs. buying 5 singles

- Clear label: x5

This wasn’t just a bundle — it was a new default offer, promoted as the main variant in Google Ads and on the product page.

- Set higher bids on the 5-pack SKU using portfolio bid strategies

Result

- AOV ↑ (+33%)

- Bundle became 30% of total yeast sales

- Higher margin absorbed slightly elevated CPCs

✅ ROAS exceeded 750% across non-branded campaigns

✅ 16% increase in conversions despite lower overall spend

✅ Sustainable structure

ROAS | Conversions | AOV

Key Takeaways for Google Ads Specialists

1. PMax is Risky for Yeast & Fermentation Products

Google often misinterprets product intent. Manual control is safer.

2. Audience Segmentation Is Non-Negotiable

In volatile markets, who sees your ad matters more than what they search for.

3. Bundles Increase AOV & Justify Higher Bids

Promote kits or bulk sets — they convert better and improve margins.

4. Use Negative Keywords

Filter out low-intent, high-risk queries to protect brand and budget.

5. Structure Prevents Self-Competition

Separate campaigns by product type + audience to avoid internal bidding wars.